:max_bytes(150000):strip_icc()/1040-SR-TaxReturnforSeniors-1-ccfefd6fef7b4798a50037db30a91193.png)

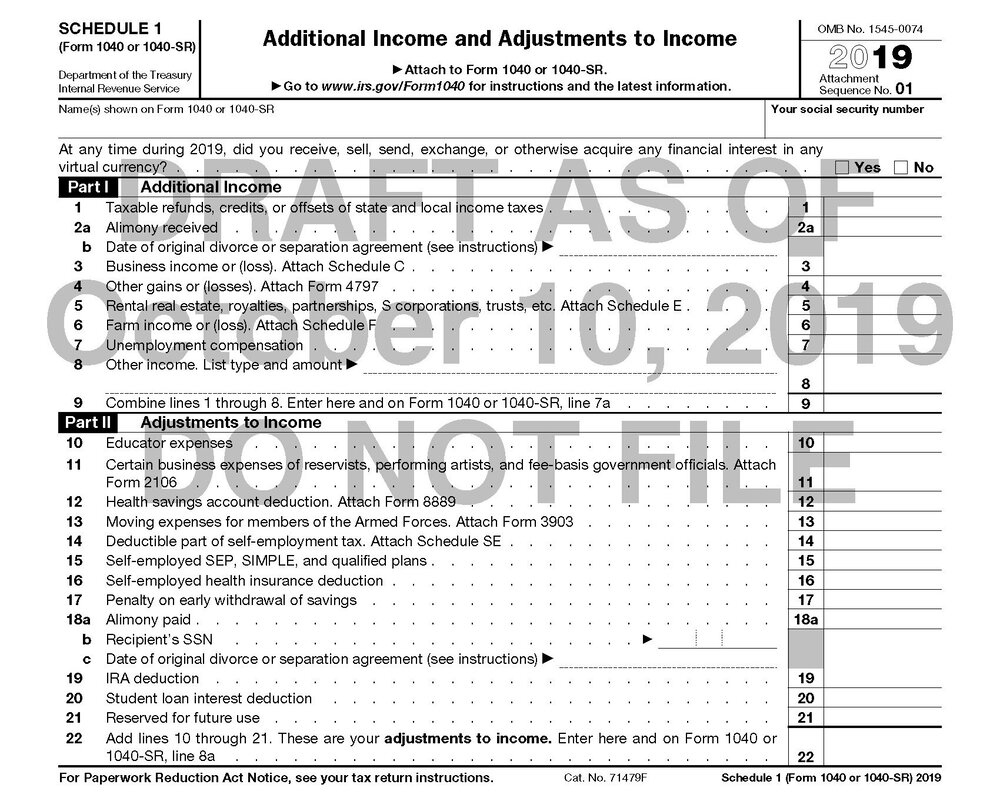

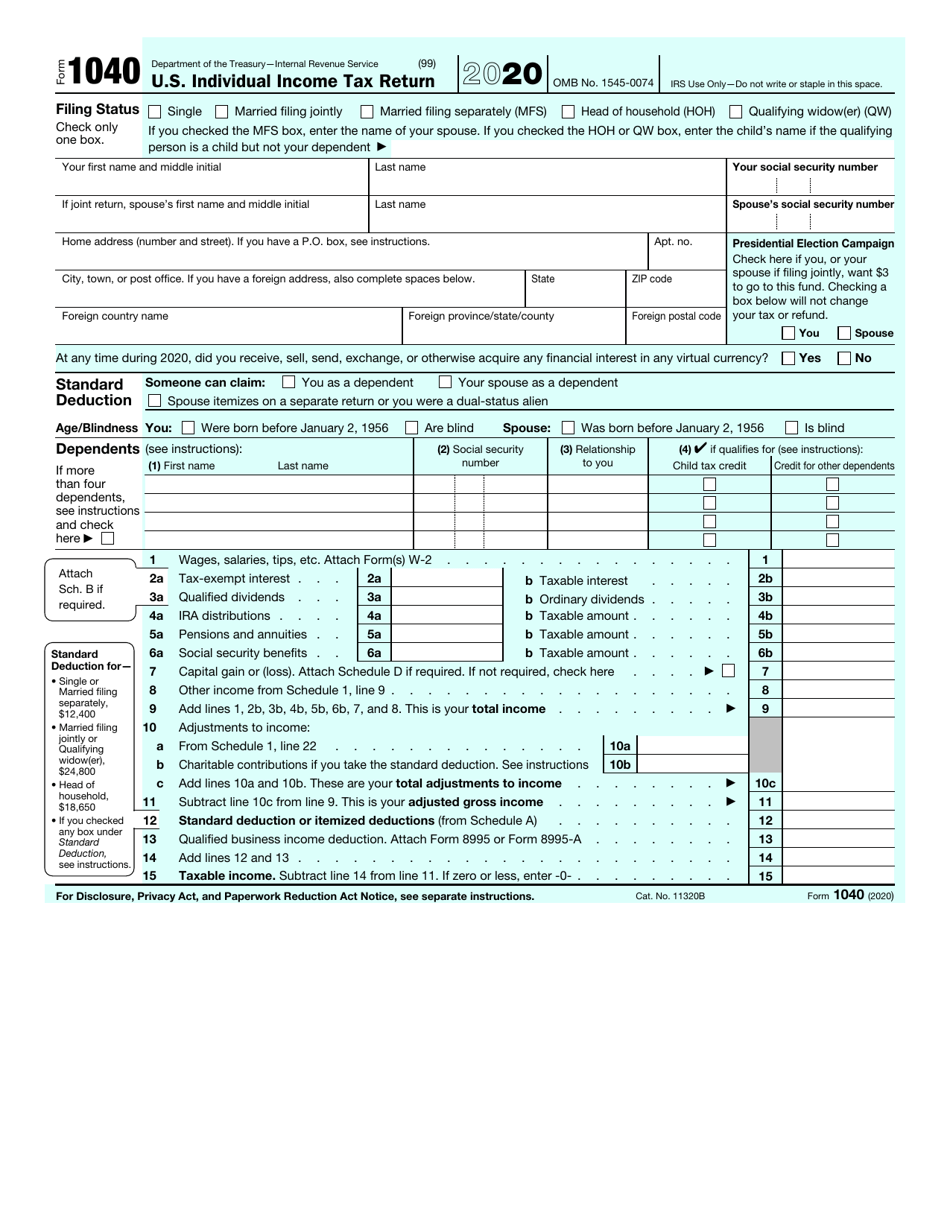

This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. 100% Accurate Calculations Guarantee – Individual Returns: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest.Ensure that you have attached all necessary forms, such as Form(s) W-2, W-2G, or 1099-R.Many tax returns are rejected due to improper methods used to calculate the tax. Ensure that you do all the calculations correctly.Ensure that the Names and Social Security Numbers (SSNs) are entered correctly for yourself as well as all your dependents in the Dependents section.The Interactive Tax Assistant on IRS.gov can help taxpayers choose the correct status, especially if more than one filing status applies. Check if you choose the correct filing status (e.g.Filing prematurely is just as risky as filing late. Wait until you have all proper tax reporting documents before filing your 1040 Form.Here are some common mistakes you can avoid when you are trying to fill out the IRS Form 1040. Especially when it comes to something as important as your tax forms. When it comes to filling our complex forms, it’s easy to make mistakes. What are the IRS 1040 Tax Form due dates? Save the form, sign it and send it to the IRS.22 is the amount of tax you still owe to the IRS (if calculated).

19 is the amount of tax you overpaid (if calculated), and No. No 37 are your form 1040 total tax payments to IRS, No.

Using all of the above, calculate and enter your adjusted gross income (AGI) on Line 8b.

0 kommentar(er)

0 kommentar(er)